Although only nanometers in size, semiconductors (aka chips or integrated circuits) are often considered the ‘world’s most critical technology’ and the ‘oil of the digital age’. Semiconductors serve as the cornerstone of most modern products, with applications spanning across civilian and military domains. They are also essential to the development of other cutting-edge technologies such as artificial intelligence (AI), supercomputing, and 5/6G communication. Thus, the ability to design, manufacture, and secure semiconductors has high and comprehensive importance to states in the contemporary world – it is not simply an advantage in economic terms but also a form of structural power in the global political-economic system.

The importance associated with semiconductors has moved it to the very centre of recent conflict and rivalry in international relations. Since 2018, the United States (U.S.) has launched a series of targeted sanctions aimed at curbing China’s access to advanced chip technologies, positioning semiconductors at the heart of its strategic contest with China’s rise. This ‘chip war’ has brought significant implications to the global landscape. For some states, such as Japan and the Netherlands, the U.S.’s open technological suppression of China has encouraged them to establish closer strategic alignment with Washington by joining, if not supporting, the sanctions. For other states, such as Germany, South Korea, and Singapore, the confrontation between the world’s two largest economies has presented a serious dilemma: how to balance dependence on U.S.-controlled technologies and supply chain with the economic imperative of engaging China’s vast market.

This evolving landscape raises fundamental questions: Is the ‘chip war’ a new Cold War? And how might it reshape the global political-economic order in the decades ahead? To address these questions, this article traces the evolution of semiconductors from their early emergence as strategic assets in the 1980s to their role in today’s political-economic system. It suggests that though the U.S.-led coalition’s technological containment of China resembles a new technological ‘iron curtain’ of the contemporary age, this divide is likely to remain far less absolute than that of the late twentieth century. In an era of hyper-globalisation and complex interdependence, conflict over semiconductors is unlikely to develop into full-scale global division and fractionalisation, but is instead most likely to persist as one of simultaneous cooperation and confrontation.

Before China, There Was Japan

The strategic importance of semiconductors did not emerge only in the twenty-first century. As early as the 1980s, the U.S. and Japan engaged in an intense trade conflict over semiconductors, which can be understood as a historical antecedent of the contemporary China–U.S. ‘chip war’. During this period, semiconductors were becoming the backbone of the global production system, powering a vast range of commodities from computers and electronic appliances to sophisticated military equipment. Japan’s rapid ascent in chip manufacturing capacity — driven by state coordination (e.g., the Very Large Scale Integration, or VLSI, program), export-oriented industrial policy, and close cooperation between the Ministry of International Trade and Industry (MITI) and corporate giants like NEC, Toshiba, and Fujitsu — enabled it to build a substantial comparative advantage in chip production.

By the mid-1980s, Japanese firms controlled nearly 80 percent of the DRAM market, displacing American producers that had once defined the industry. Washington perceived Japan’s growing dominance in the semiconductor supply chain not only as an economic challenge but also as a strategic threat, and responded with a combination of trade protection and diplomatic pressure. In 1986, Tokyo was compelled to sign the Semiconductor Trade Agreement, which required Japan to set higher prices for DRAM exports while opening 20% of its domestic market to foreign (mostly American) firms. The U.S.–Japan chip conflict revealed two enduring dynamics that continue to shape semiconductor politics today. First, it demonstrated how governments treat technological leadership as an instrument of national power, geopolitical influence, and global leadership.

is a PhD candidate in International Political Economy Research at King’s College London. His research focuses on the history of the semiconductor sector, the ‘chip war’, and their implications on long-term developments in the global political economy.

Second, it showed that interactions in core technologies are inherently characterised by both cooperation and rivalry. Although Japan remained a key strategic ally of the United States during the Cold War — and cooperated extensively with American semiconductor companies, especially in chip assembly — its industrial rise nonetheless provoked strong reactions and suppression from Washington. In retrospect, the 1980s chip conflict meaningfully marked the beginning of a global recognition that semiconductors were not just commercial goods but strategic assets central to the distribution of power in the international system. The dispute pushed the U.S. to rebuild its domestic innovation ecosystem and promoted the rise of South Korea and Taiwan as new players in the semiconductor value chain. These changes jointly set the stage for the transnational production networks that dominate the industry today.

Built in America, Assembled in Asia

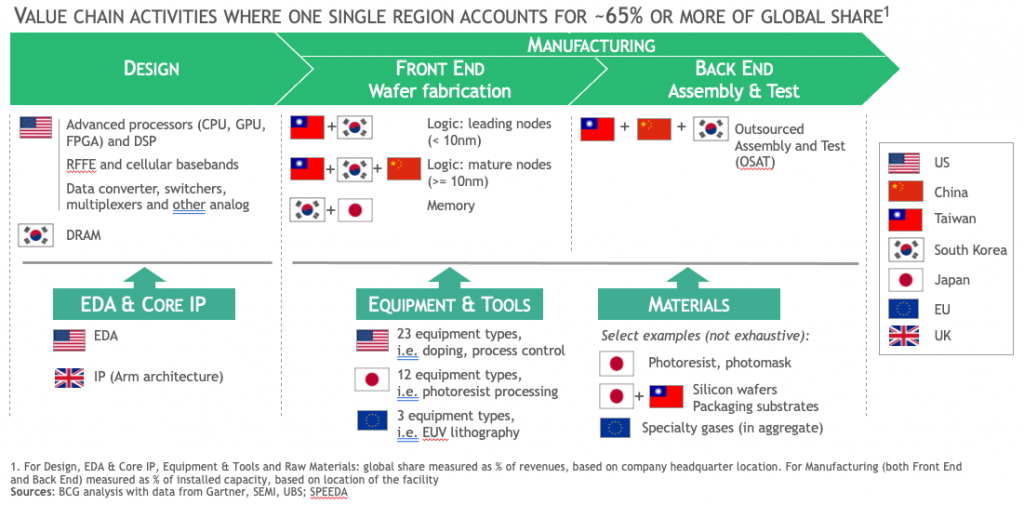

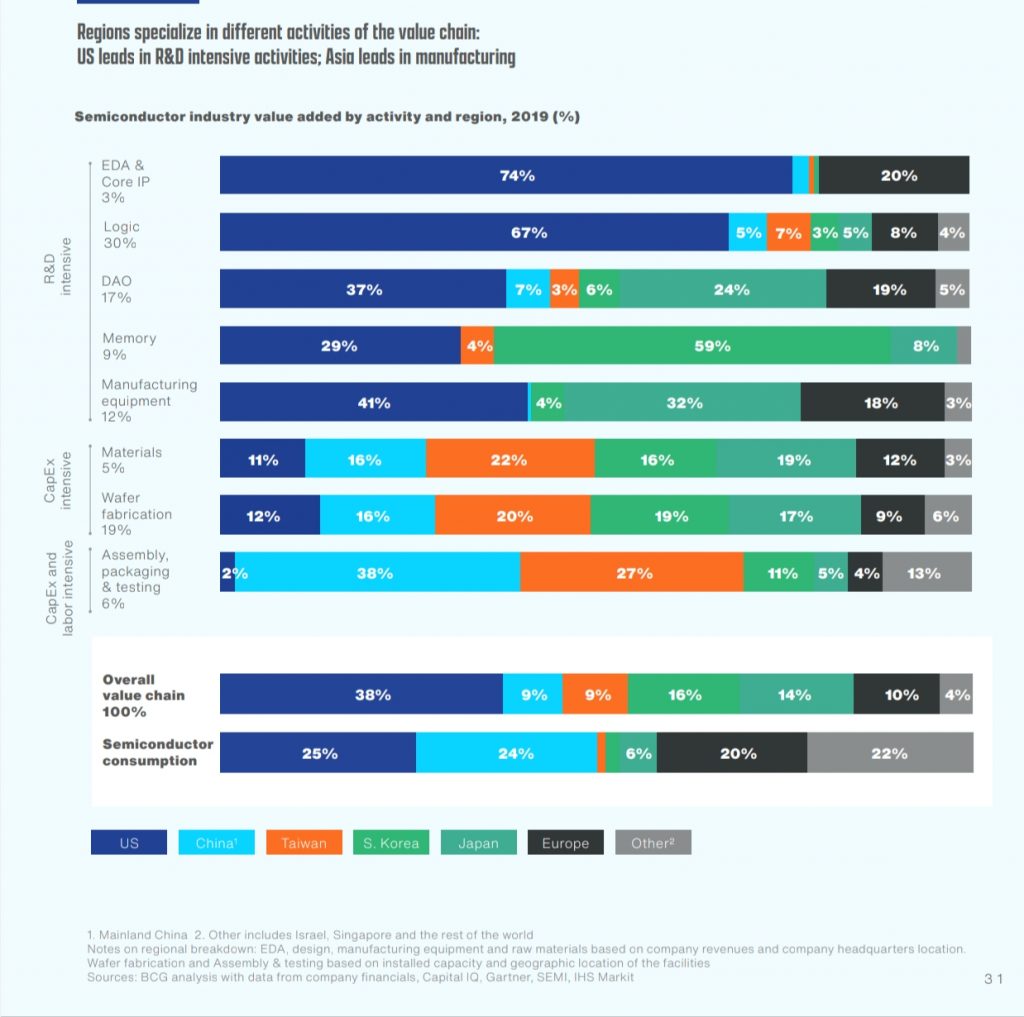

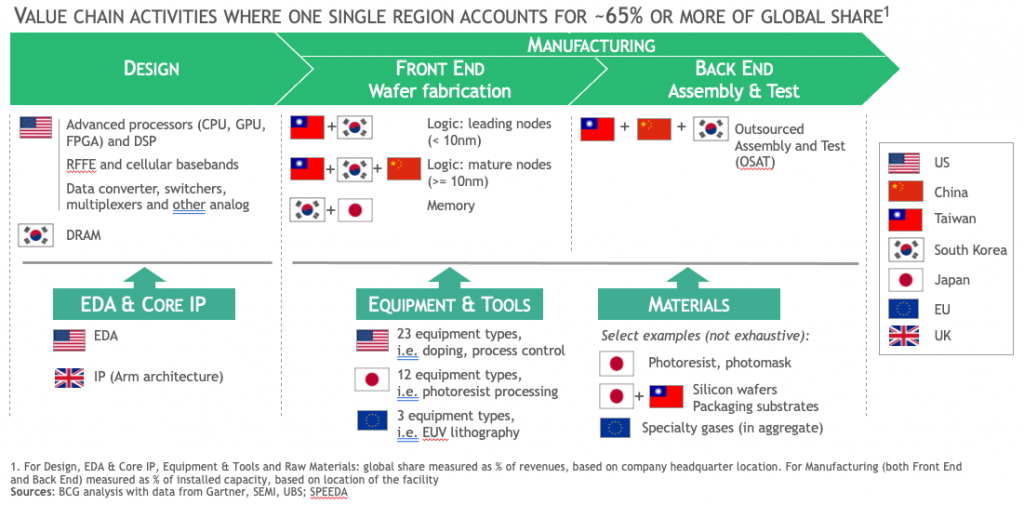

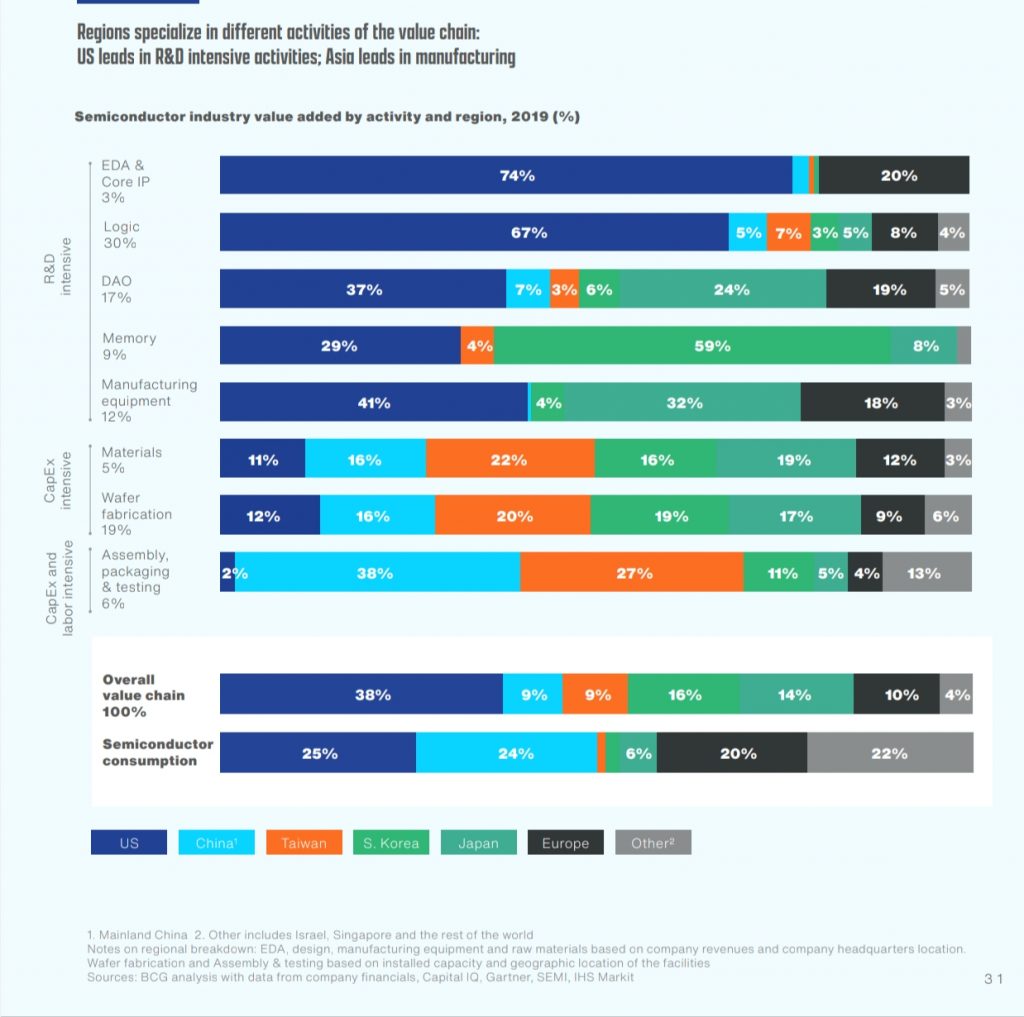

The global semiconductor industry today operates through one of the most complex supply chains ever created. From the initial stage of design to the final stage of testing, the manufacture of a single chip often involves participation from hundreds of firms based in dozens of countries. Yet despite this wide participation, the most critical, high-value-added, and technologically sophisticated stages of production remain overwhelmingly concentrated in the hands of the U.S. and its close allies. This asymmetric structure has given Washington a unique degree of leverage over the global chip ecosystem.

At the top of the value chain lies chip design and electronic design automation (EDA). This stage holds foundational importance and underpins the entire supply chain. It determines how billions of transistors are arranged, how electrical flows are organised, and how performance and efficiency are optimised. Without this process, semiconductors would remain abstract engineering concepts rather than functioning commodities. This important stage in chip production is dominated almost entirely by American firms such as Synopsys, Cadence, and Siemens EDA (formerly Mentor Graphics, which was also U.S.-based).

Nearly all chip designers in the world, including those in China, depend on them for the design infrastructure. Without access to their systems and software, advanced semiconductor design is nearly impossible. The next critical layer is fabrication, the process that transforms designs into physical products. Although the U.S. has outsourced much of its own fabrication capacity abroad, the world’s most advanced foundries are still operated by its strategic allies — Taiwan and South Korea. Taiwan’s TSMC and South Korea’s Samsung dominate global advanced manufacturing, with TSMC alone producing over 90 percent of chips below 7 nanometres.

Chip fabrication is inseparable from the supply of highly sophisticated manufacturing equipment and chemical materials. For the former, modern chip production relies heavily on lithography machines, particularly extreme ultraviolet (EUV) systems required to produce cutting-edge chips under 7nm. The Dutch company ASML holds a global monopoly over EUV lithography. However, even this champion depends heavily on American inputs. ASML manufactures only around 15 percent of an EUV machine’s components in-house and sources the remaining 85 percent of the parts from numerous suppliers, including Texas Instruments and Applied Materials in the U.S., as well as Zeiss in Germany.

For materials, Japanese firms such as Tokyo Electron, Shin-Etsu Chemical, and Sumco dominate key segments, including photoresists, silicon wafers, and chemical gases — components essential for chip manufacturing at advanced nodes. These companies are also extensively integrated into the U.S.-centred technological network and thus subject to its industry-wide influence. The final and yet least value-added part of the semiconductor supply chain is assembly, packaging, and testing, which is sometimes also referred to as outsourced assembly and testing (OSAT). China is a major player in this downstream segment, with firms like JCET and Tongfu Microelectronics holding significant market shares.

Second, it showed that interactions in core technologies are inherently characterised by both cooperation and rivalry. Although Japan remained a key strategic ally of the United States during the Cold War — and cooperated extensively with American semiconductor companies, especially in chip assembly — its industrial rise nonetheless provoked strong reactions and suppression from Washington. In retrospect, the 1980s chip conflict meaningfully marked the beginning of a global recognition that semiconductors were not just commercial goods but strategic assets central to the distribution of power in the international system. The dispute pushed the U.S. to rebuild its domestic innovation ecosystem and promoted the rise of South Korea and Taiwan as new players in the semiconductor value chain. These changes jointly set the stage for the transnational production networks that dominate the industry today.

Built in America, Assembled in Asia

The global semiconductor industry today operates through one of the most complex supply chains ever created. From the initial stage of design to the final stage of testing, the manufacture of a single chip often involves participation from hundreds of firms based in dozens of countries. Yet despite this wide participation, the most critical, high-value-added, and technologically sophisticated stages of production remain overwhelmingly concentrated in the hands of the U.S. and its close allies. This asymmetric structure has given Washington a unique degree of leverage over the global chip ecosystem.

At the top of the value chain lies chip design and electronic design automation (EDA). This stage holds foundational importance and underpins the entire supply chain. It determines how billions of transistors are arranged, how electrical flows are organised, and how performance and efficiency are optimised. Without this process, semiconductors would remain abstract engineering concepts rather than functioning commodities. This important stage in chip production is dominated almost entirely by American firms such as Synopsys, Cadence, and Siemens EDA (formerly Mentor Graphics, which was also U.S.-based).

Nearly all chip designers in the world, including those in China, depend on them for the design infrastructure. Without access to their systems and software, advanced semiconductor design is nearly impossible. The next critical layer is fabrication, the process that transforms designs into physical products. Although the U.S. has outsourced much of its own fabrication capacity abroad, the world’s most advanced foundries are still operated by its strategic allies — Taiwan and South Korea. Taiwan’s TSMC and South Korea’s Samsung dominate global advanced manufacturing, with TSMC alone producing over 90 percent of chips below 7 nanometres.

Chip fabrication is inseparable from the supply of highly sophisticated manufacturing equipment and chemical materials. For the former, modern chip production relies heavily on lithography machines, particularly extreme ultraviolet (EUV) systems required to produce cutting-edge chips under 7nm. The Dutch company ASML holds a global monopoly over EUV lithography. However, even this champion depends heavily on American inputs. ASML manufactures only around 15 percent of an EUV machine’s components in-house and sources the remaining 85 percent of the parts from numerous suppliers, including Texas Instruments and Applied Materials in the U.S., as well as Zeiss in Germany.

For materials, Japanese firms such as Tokyo Electron, Shin-Etsu Chemical, and Sumco dominate key segments, including photoresists, silicon wafers, and chemical gases — components essential for chip manufacturing at advanced nodes. These companies are also extensively integrated into the U.S.-centred technological network and thus subject to its industry-wide influence. The final and yet least value-added part of the semiconductor supply chain is assembly, packaging, and testing, which is sometimes also referred to as outsourced assembly and testing (OSAT). China is a major player in this downstream segment, with firms like JCET and Tongfu Microelectronics holding significant market shares.

China’s ultimate ambition behind these efforts is to break free from the U.S.’s techno-economic supremacy and thereby further accelerate its national development.

However, in the front-end processes — where technological complexity, intellectual property, and strategic value are concentrated — China still remains heavily dependent on foreign suppliers. While Chinese firms such as Huawei HiSilicon, ZTE, and Guoxin Microelectronics have achieved progress in chip design, and foundries such as SMIC and Huahong have improved manufacturing capabilities, they still lag several generations behind global leaders. China’s participation in the global semiconductor supply chain thus remains largely concentrated in the OSAT stage, where technological barriers are relatively limited.

However, in the front-end processes — where technological complexity, intellectual property, and strategic value are concentrated — China still remains heavily dependent on foreign suppliers. While Chinese firms such as Huawei HiSilicon, ZTE, and Guoxin Microelectronics have achieved progress in chip design, and foundries such as SMIC and Huahong have

The concentration of most high–value-added and critical stages of semiconductor production within the U.S. and its allied network has rendered the global supply chain highly asymmetric. The entire system depends on a handful of chokepoints — EDA software, lithography machines, and process technologies — most of which remain within the jurisdictional or regulatory reach of the U.S. Consequently, the contemporary supply chain of semiconductors is easily subject to politicisation and weaponisation by the U.S. as a means of exerting strategic influence over other nations. This feature has been a defining characteristic of the contemporary semiconductor ecosystem, shaping the patterns of interaction and conflict among major powers in today’s geopolitical landscape.

The Interdependence Trap

Although China is the world’s second-largest economy, possesses the largest industrial production capacity, and contributes to the world’s largest manufacturing outputs, its manufacturing strength remains constrained by its dependence on critical chip technologies controlled by the U.S. Recalling the discussions above, China’s chip industry still hinges on several chokepoints — ranging from electronic design automation (EDA) software to lithography equipment — that remain beyond its control. Without an indigenous capacity to produce advanced semiconductors, China’s industrial system faces severe constraints in manufacturing sophisticated electronic products such as smartphones, computers, and advanced machinery.

Beijing has long recognised this vulnerability. As early as 2015, it declared technological self-sufficiency in semiconductors a national strategic goal, embedding it in initiatives such as Made in China 2025, the innovation-driven development strategy, and the establishment of the National Integrated Circuit Industry Investment Fund (the ‘Big Fund’). China’s ultimate ambition behind these efforts is to break free from the U.S.’s techno-economic supremacy and thereby further accelerate its national development. This systematic attempt to challenge the U.S.’s technological superiority ultimately triggered Washington to launch the ‘chip war’ to slow Beijing’s progress and preserve U.S. dominance at the technological frontier.

Beginning in 2018, the Bureau of Industry and Security (BIS) imposed targeted sanctions against key Chinese firms such as Huawei and SMIC, restricting their technology-purchasing and sharing operations outside China. Then, from 2022 onwards, the Biden administration extended this approach into a comprehensive export control regime, fully restricting the flow of advanced chips, chip-making machines, and industrial experts to China. Responding to Washington’s call, several allies — most notably Japan and the Netherlands — joined the effort, limiting exports of advanced lithography equipment and chemical materials to China.

This confrontation has inevitably raised the question of whether the world is witnessing the emergence of a new Cold War. On the surface, the technological barriers erected by the U.S. and its allies — through their dominance over the semiconductor industry — resemble a new ‘iron curtain’. It also mirrors a broader struggle of ideologies, economic models, and production systems, one between state-led capitalism and industrial policy on the Chinese side versus market-oriented capitalism among the U.S. and its allies. However, this article argues that the ongoing ‘chip war’ is not equivalent to a new Cold War.

Under conditions of globalisation and complex interdependence, the fragmentation of the semiconductor sector and the rivalry for technological leadership have not yet produced divisions as deep or as comprehensive as those of the late twentieth century. For instance, several major U.S. allies, including Germany and South Korea, find themselves caught in a difficult dilemma between supporting U.S. strategic objectives and maintaining access to the vast Chinese market.

Even Washington itself has avoided a total break-off with Beijing. In August 2025, the Trump administration reportedly permitted Nvidia to export its AI chips, such as H20, to China in exchange for 15% of the revenue from those sales. This shows signs of continued negotiation, discussion, and limited cooperation between the two powers amidst confrontation. The underlying reason, as perceived by this article, is straightforward: while the U.S. and its allies dominate the upper tiers of the semiconductor supply chain, the ‘chip war’ concerns not only the industry itself but is instead embedded within the broader structure of the global economy, where China remains indispensable.

The U.S. and its partners continue to depend on China’s immense industrial capacity, its vast demand, and its key natural resources, such as rare earth minerals. A world in which China’s economy is devastated — and its factories silenced — would hardly benefit either side. Thus, at least in the short term, the confrontation over semiconductors is unlikely to escalate into a full-scale global division or complete decoupling. Instead, it is likely to persist as a paradoxical order — one defined by simultaneous cooperation and confrontation, where technological rivalry unfolds within an enduring framework of economic interdependence.

Two Paths, One Future

As the foundation of the digital age, semiconductors will likely remain indispensable in global power competitions. In an era where technologies such as artificial intelligence (AI) and 6G communications are redefining innovation and future national strength, control over semiconductors will continue to determine the global hierarchy of technological power. For the short term at least, the semiconductor sector is likely to remain both an engine of cooperation and a source of tension. The interwoven nature of global production networks has made absolute decoupling improbable. At the same time, however, technological self-sufficiency and leadership in strategic sectors will remain key policy priorities, inevitably leading to friction and contestation along the semiconductor supply chain. While the competition over semiconductors is expected to persist as one of simultaneous cooperation and confrontation in the near future, two factors will be decisive in shaping the long-term trajectory of this struggle.

The first is China’s capacity to overcome its technological chokepoints. Whether Beijing can achieve breakthroughs in areas such as lithography, advanced design, and materials science will determine how far it can reduce its dependence on the U.S.-led ecosystem, and therefore the extent to which it can redefine the global technological hierarchy. If Beijing succeeds in achieving genuine technological breakthroughs, it might be enabled to build a parallel technological sphere — one that offers alternative standards, supply networks, and innovation models to those of the U.S. — and thereby deepen the global shift toward technological multipolarity.

The second is America’s willingness to reconsider its global role: whether it continues to act as a hegemon defending its dominance, or recalibrates its international posture to concentrate resources on domestic renewal and development. If the U.S. persists in safeguarding its hegemony through containment and strategic competition, the conflict over semiconductors is likely to endure, further entrenching global technological divisions. Whereas, if Washington decides to step back from costly power confrontations and prioritise solutions to its own socio-economic challenges — such as deindustrialisation and declining productivity — it may adopt a more cooperative stance. Such a shift could ease tensions within the semiconductor domain and foster limited yet meaningful coordination among major powers.

improved manufacturing capabilities, they still lag several generations behind global leaders. China’s participation in the global semiconductor supply chain thus remains largely concentrated in the OSAT stage, where technological barriers are relatively limited.

The concentration of most high–value-added and critical stages of semiconductor production within the U.S. and its allied network has rendered the global supply chain highly asymmetric. The entire system depends on a handful of chokepoints — EDA software, lithography machines, and process technologies — most of which remain within the jurisdictional or regulatory reach of the U.S. Consequently, the contemporary supply chain of semiconductors is easily subject to politicisation and weaponisation by the U.S. as a means of exerting strategic influence over other nations. This feature has been a defining characteristic of the contemporary semiconductor ecosystem, shaping the patterns of interaction and conflict among major powers in today’s geopolitical landscape.

The Interdependence Trap

Although China is the world’s second-largest economy, possesses the largest industrial production capacity, and contributes to the world’s largest manufacturing outputs, its manufacturing strength remains constrained by its dependence on critical chip technologies controlled by the U.S. Recalling the discussions above, China’s chip industry still hinges on several chokepoints — ranging from electronic design automation (EDA) software to lithography equipment — that remain beyond its control. Without an indigenous capacity to produce advanced semiconductors, China’s industrial system faces severe constraints in manufacturing sophisticated electronic products such as smartphones, computers, and advanced machinery.

Beijing has long recognised this vulnerability. As early as 2015, it declared technological self-sufficiency in semiconductors a national strategic goal, embedding it in initiatives such as Made in China 2025, the innovation-driven development strategy, and the establishment of the National Integrated Circuit Industry Investment Fund (the ‘Big Fund’). China’s ultimate ambition behind these efforts is to break free from the U.S.’s techno-economic supremacy and thereby further accelerate its national development. This systematic attempt to challenge the U.S.’s technological superiority ultimately triggered Washington to launch the ‘chip war’ to slow Beijing’s progress and preserve U.S. dominance at the technological frontier.

Beginning in 2018, the Bureau of Industry and Security (BIS) imposed targeted sanctions against key Chinese firms such as Huawei and SMIC, restricting their technology-purchasing and sharing operations outside China. Then, from 2022 onwards, the Biden administration extended this approach into a comprehensive export control regime, fully restricting the flow of advanced chips, chip-making machines, and industrial experts to China. Responding to Washington’s call, several allies — most notably Japan and the Netherlands — joined the effort, limiting exports of advanced lithography equipment and chemical materials to China.

This confrontation has inevitably raised the question of whether the world is witnessing the emergence of a new Cold War. On the surface, the technological barriers erected by the U.S. and its allies — through their dominance over the semiconductor industry — resemble a new ‘iron curtain’. It also mirrors a broader struggle of ideologies, economic models, and production systems, one between state-led capitalism and industrial policy on the Chinese side versus market-oriented capitalism among the U.S. and its allies. However, this article argues that the ongoing ‘chip war’ is not equivalent to a new Cold War.

Under conditions of globalisation and complex interdependence, the fragmentation of the semiconductor sector and the rivalry for technological leadership have not yet produced divisions as deep or as comprehensive as those of the late twentieth century. For instance, several major U.S. allies, including Germany and South Korea, find themselves caught in a difficult dilemma between supporting U.S. strategic objectives and maintaining access to the vast Chinese market.

Even Washington itself has avoided a total break-off with Beijing. In August 2025, the Trump administration reportedly permitted Nvidia to export its AI chips, such as H20, to China in exchange for 15% of the revenue from those sales. This shows signs of continued negotiation, discussion, and limited cooperation between the two powers amidst confrontation. The underlying reason, as perceived by this article, is straightforward: while the U.S. and its allies dominate the upper tiers of the semiconductor supply chain, the ‘chip war’ concerns not only the industry itself but is instead embedded within the broader structure of the global economy, where China remains indispensable.

The U.S. and its partners continue to depend on China’s immense industrial capacity, its vast demand, and its key natural resources, such as rare earth minerals. A world in which China’s economy is devastated — and its factories silenced — would hardly benefit either side. Thus, at least in the short term, the confrontation over semiconductors is unlikely to escalate into a full-scale global division or complete decoupling. Instead, it is likely to persist as a paradoxical order — one defined by simultaneous cooperation and confrontation, where technological rivalry unfolds within an enduring framework of economic interdependence.

Two Paths, One Future

As the foundation of the digital age, semiconductors will likely remain indispensable in global power competitions. In an era where technologies such as artificial intelligence (AI) and 6G communications are redefining innovation and future national strength, control over semiconductors will continue to determine the global hierarchy of technological power. For the short term at least, the semiconductor sector is likely to remain both an engine of cooperation and a source of tension. The interwoven nature of global production networks has made absolute decoupling improbable. At the same time, however, technological self-sufficiency and leadership in strategic sectors will remain key policy priorities, inevitably leading to friction and contestation along the semiconductor supply chain. While the competition over semiconductors is expected to persist as one of simultaneous cooperation and confrontation in the near future, two factors will be decisive in shaping the long-term trajectory of this struggle.

The first is China’s capacity to overcome its technological chokepoints. Whether Beijing can achieve breakthroughs in areas such as lithography, advanced design, and materials science will determine how far it can reduce its dependence on the U.S.-led ecosystem, and therefore the extent to which it can redefine the global technological hierarchy. If Beijing succeeds in achieving genuine technological breakthroughs, it might be enabled to build a parallel technological sphere — one that offers alternative standards, supply networks, and innovation models to those of the U.S. — and thereby deepen the global shift toward technological multipolarity.

The second is America’s willingness to reconsider its global role: whether it continues to act as a hegemon defending its dominance, or recalibrates its international posture to concentrate resources on domestic renewal and development. If the U.S. persists in safeguarding its hegemony through containment and strategic competition, the conflict over semiconductors is likely to endure, further entrenching global technological divisions. Whereas, if Washington decides to step back from costly power confrontations and prioritise solutions to its own socio-economic challenges — such as deindustrialisation and declining productivity — it may adopt a more cooperative stance. Such a shift could ease tensions within the semiconductor domain and foster limited yet meaningful coordination among major powers.

Recommended

Soft Power, Hard Tactics, and U.S. Resistance

Soft Power, Hard Tactics, and U.S. Resistance

What is the Ideal American Foreign Policy in the Multipolar World?

How the War in Ukraine Redefined Europe?

How Progressive America Redefined Its Stance on Israel?